My blog gives all data, facts and statistics about global real politic economic system, factors of production, poverty and inequality. Also I give information about popular hedonic life of human-beings. I believe that economy science must become a holistic social science that includes all multi dimensions of human (body, mind, soul) and to give inspiration (motivation) to become perfect "homo-economicus" generations for the 21th century.

2/27/2018

2/26/2018

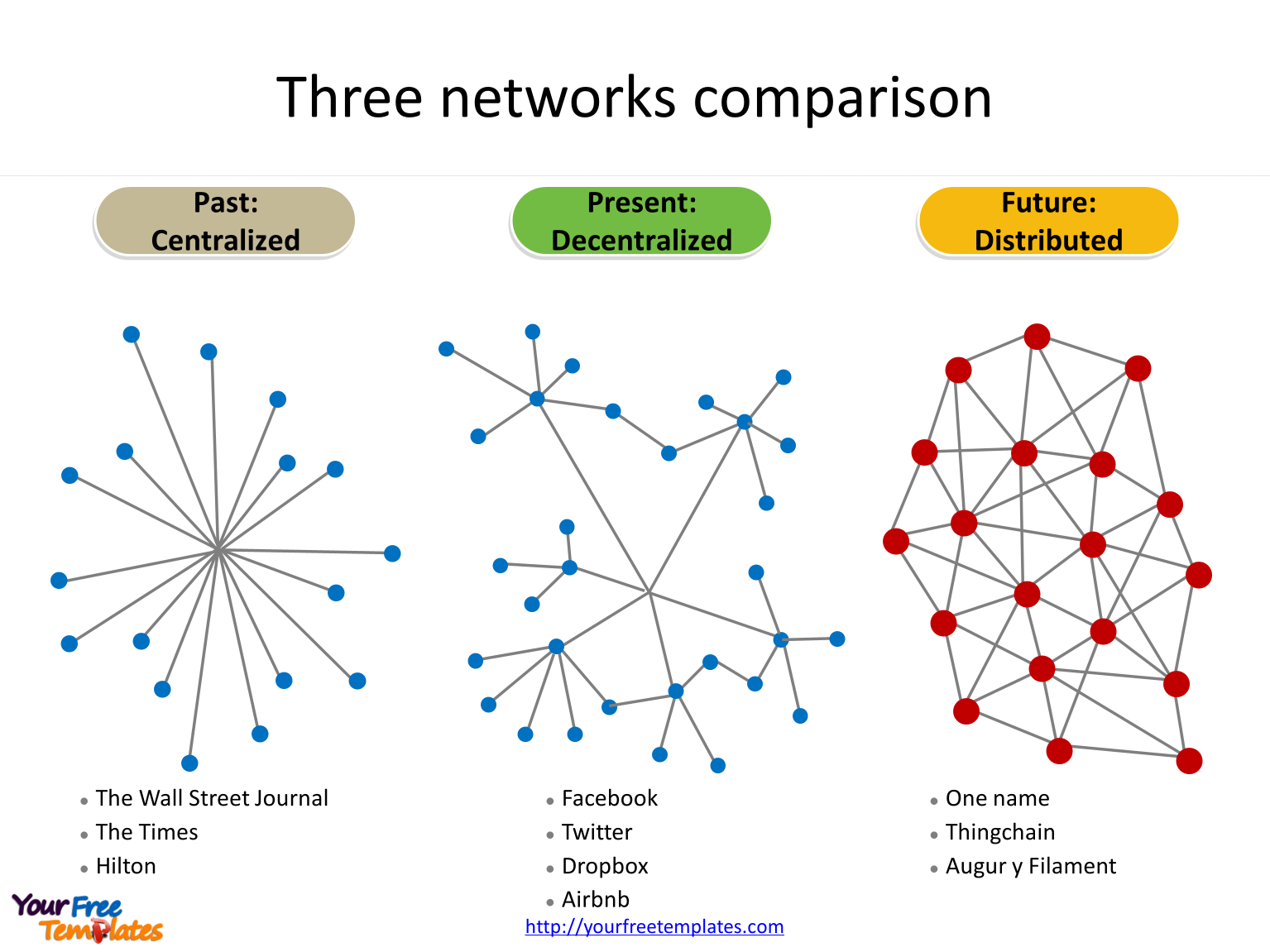

Cloud Computing

The demand for the IT professionals in the cloud computing section has risen significantly because of the development of cloud technologies. Many companies wonder which cloud computing certifications are qualified. Here is the list of the best cloud computing certifications for 2017.

More and more companies invest in the cloud computing as their important tool in the business. With different users, there will be various definitions of the cloud computing. We cannot deny that the cloud is currently an enduring fixture for last users and service suppliers. Therefore, certification from suppliers and firms which provided cloud-related product, such as Amazon Web services, Microsoft and VMware, and other uncounted brands, are spotlight and attracts sizable coverage.

An informational Forbes article reports that key statistics are relating to the present cloud computing landscape along with a vision to the future. Amazon Web Service (AWS) is the leading cloud computing player, followed by Microsoft Azure, the Rackspace Public Cloud and VMware’s vCloud. Microsoft is anticipated to grow to 30 percent of the cloud product revenue in 2018.

The revenue of the cloud infrastructure and platform is $38 billion. It is predicted that the number will be $173 billion by 2026. The cloud services are unlimited which can be used in the range of an enterprises to large corporations. There are 64 percent of small and medium-sized businesses (SMBs) also use the cloud-based applications. An estimated 78 percent of businesses are planning to obtain modern cloud-based solutions within the next few years.

Jennifer Lawrence Net Worth...

Jennifer Lawrence now has an estimated net worth of $130 million in 2017. Jennifer once convinced her family to move to NYC so that she can pursue an acting career. It happened when she was in her early teens.

https://www.therichest.com/celebnetworth/celeb/actress/jennifer-lawrence-net-worth/

https://www.therichest.com/celebnetworth/celeb/actress/jennifer-lawrence-net-worth/

Selena Gomez Net Worth...

Net Worth:$50 Million American actress and singer "Selena Gomez" has an estimated net worth of $50 million.

American actress and singer "Selena Gomez" has an estimated net worth of $50 million.

Unemployment insurance and worker mobility

After an involuntary job loss, unemployed individuals suffer large and persistent negative impacts on their earnings. The unemployment insurance (UI) program offsets a significant proportion of income losses and helps to facilitate consumption smoothing after these negative shocks. But what effects does UI have on labor market outcomes for recipients?

Recently, researchers have been concerned that worker mobility has been declining as labor markets become less flexible. Diminished mobility can impact wages and job match quality. In “Unemployment insurance and worker mobility” (PDF), Brookings fellow Ryan Nunn, Laura Kawano, and Ben Klemens examine the effects of unemployment insurance on geographic mobility.

Ryan Nunn, Laura Kawano, and Ben Klemens

Misbehaving

![Misbehaving: The Making of Behavioral Economics by [Thaler, Richard H.]](https://images-na.ssl-images-amazon.com/images/I/51dqaYXmQOL.jpg)

Nobel laureate Richard H. Thaler has spent his career studying the radical notion that the central agents in the economy are humans—predictable, error-prone individuals. Misbehaving is his arresting, frequently hilarious account of the struggle to bring an academic discipline back down to earth—and change the way we think about economics, ourselves, and our world.

Traditional economics assumes rational actors. Early in his research, Thaler realized these Spock-like automatons were nothing like real people. Whether buying a clock radio, selling basketball tickets, or applying for a mortgage, we all succumb to biases and make decisions that deviate from the standards of rationality assumed by economists. In other words, we misbehave. More importantly, our misbehavior has serious consequences. Dismissed at first by economists as an amusing sideshow, the study of human miscalculations and their effects on markets now drives efforts to make better decisions in our lives, our businesses, and our governments.

Coupling recent discoveries in human psychology with a practical understanding of incentives and market behavior, Thaler enlightens readers about how to make smarter decisions in an increasingly mystifying world. He reveals how behavioral economic analysis opens up new ways to look at everything from household finance to assigning faculty offices in a new building, to TV game shows, the NFL draft, and businesses like Uber.

Phishing for Phools...

![Phishing for Phools: The Economics of Manipulation and Deception by [Akerlof, George A., Shiller, Robert J.]](https://images-na.ssl-images-amazon.com/images/I/51tkIlY3oqL.jpg)

Ever since Adam Smith, the central teaching of economics has been that free markets provide us with material well-being, as if by an invisible hand. In Phishing for Phools, Nobel Prize–winning economists George Akerlof and Robert Shiller deliver a fundamental challenge to this insight, arguing that markets harm as well as help us. As long as there is profit to be made, sellers will systematically exploit our psychological weaknesses and our ignorance through manipulation and deception. Rather than being essentially benign and always creating the greater good, markets are inherently filled with tricks and traps and will "phish" us as "phools."

Phishing for Phools therefore strikes a radically new direction in economics, based on the intuitive idea that markets both give and take away. Akerlof and Shiller bring this idea to life through dozens of stories that show how phishing affects everyone, in almost every walk of life. We spend our money up to the limit, and then worry about how to pay the next month's bills. The financial system soars, then crashes. We are attracted, more than we know, by advertising. Our political system is distorted by money. We pay too much for gym memberships, cars, houses, and credit cards. Drug companies ingeniously market pharmaceuticals that do us little good, and sometimes are downright dangerous.

Phishing for Phools explores the central role of manipulation and deception in fascinating detail in each of these areas and many more. It thereby explains a paradox: why, at a time when we are better off than ever before in history, all too many of us are leading lives of quiet desperation. At the same time, the book tells stories of individuals who have stood against economic trickery—and how it can be reduced through greater knowledge, reform, and regulation.

Animal Spirits...

The global financial crisis has made it painfully clear that powerful psychological forces are imperiling the wealth of nations today. From blind faith in ever-rising housing prices to plummeting confidence in capital markets, "animal spirits" are driving financial events worldwide. In this book, acclaimed economists George Akerlof and Robert Shiller challenge the economic wisdom that got us into this mess, and put forward a bold new vision that will transform economics and restore prosperity.

Akerlof and Shiller reassert the necessity of an active government role in economic policymaking by recovering the idea of animal spirits, a term John Maynard Keynes used to describe the gloom and despondence that led to the Great Depression and the changing psychology that accompanied recovery. Like Keynes, Akerlof and Shiller know that managing these animal spirits requires the steady hand of government--simply allowing markets to work won't do it. In rebuilding the case for a more robust, behaviorally informed Keynesianism, they detail the most pervasive effects of animal spirits in contemporary economic life--such as confidence, fear, bad faith, corruption, a concern for fairness, and the stories we tell ourselves about our economic fortunes--and show how Reaganomics, Thatcherism, and the rational expectations revolution failed to account for them.

Animal Spirits offers a road map for reversing the financial misfortunes besetting us today. Read it and learn how leaders can channel animal spirits--the powerful forces of human psychology that are afoot in the world economy today. In a new preface, they describe why our economic troubles may linger for some time--unless we are prepared to take further, decisive action.

Kaydol:

Yorumlar (Atom)

Why the heck is there still an automotive chip shortage?

A side from the raw, human toll, COVID-19 has dramatically changed how we live, from travel and education to the way people work. This ...

-

The beauty of science may be pure and eternal, but the practice of science costs money. And scientists, being human, respond to incentives ...

-

Roubini is one of few economists who predicted the housing bubble crash of 2007-2008. He warned about the crisis in an IMF position paper in...

-

Blockchain technology has the potential to reduce costs, improve product offerings and increase speed for banks, according to the most rec...